Can You Buy Long Term Care Insurance After 70

E+/ Getty Images

En español | Being slammed with exorbitant bills for a nursing home stay is among the biggest potential budget busters in retirement.

That's why getting insurance to cover a chunk of the costs for in-home care, an assisted living facility or a private room in a nursing home is a personal finance move to consider. The key, though, is getting the most bang for your insurance premium bucks.

The catch? The price of long-term care coverage can be cost-prohibitive.

The national median daily cost for a private bed in a nursing home in 2019 was $280 a day, or $102,200 a year — up nearly 2 percent from a year ago, according to insurance company Genworth's 2019 cost of care survey. A yearlong stay in your own room at an assisted living facility runs $48,612.

Those are big numbers that can eat through a retirement nest egg quickly. The average 401(k) balance was $105,200 at the end of September 2019, according to Fidelity Investments.

What's the sweet spot?

So what's the right age to buy a long-term care policy that keeps premiums affordable while saving you money on total premiums paid over the life of the policy?

Sure, you could get a policy with a lower premium in your 40s or when you turn 50. But you'll likely be paying premiums for more than two decades before you file a claim.

Shopping for long-term care insurance

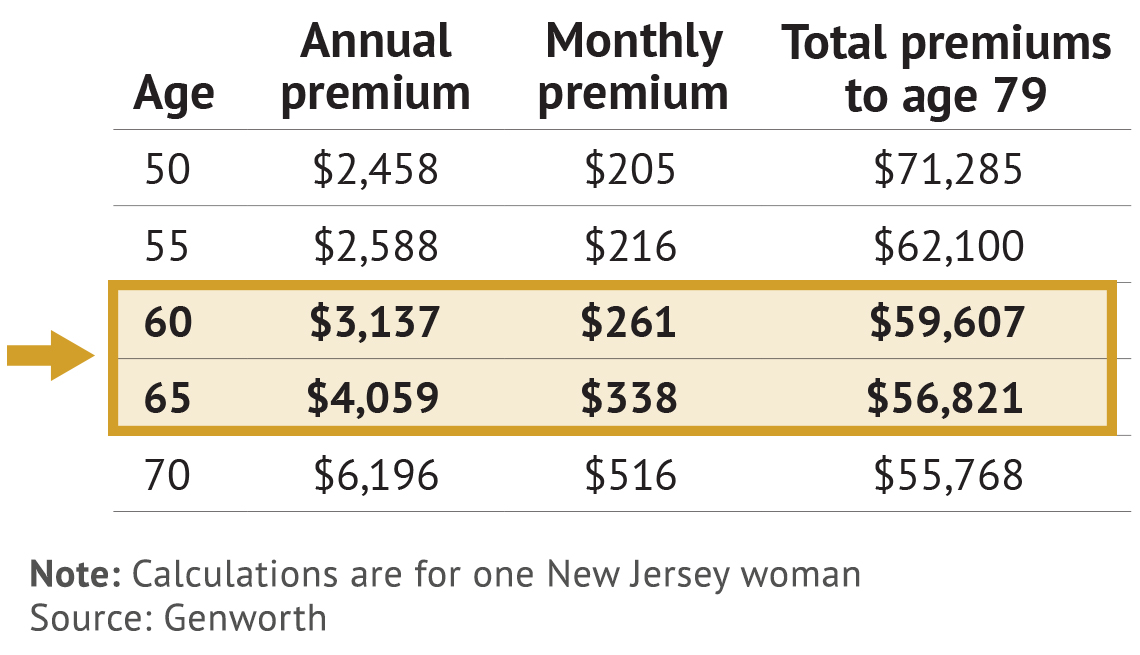

Long-term care insurance premiums are cheaper at a younger age. But shopping for a policy between 60 and 65, starting at age 55 for couples, may get you the best combination of monthly affordability and fewer total dollars spent.

People older than 70 file more than 95 percent of long-term care insurance claims, and nearly 7 in 10 claims are filed after age 81, the American Association for Long-Term Care Insurance reports.

But if you live in New Jersey and wait until age 70 to purchase a policy that pays $250 a day for a private room in a nursing home for up to two years, your monthly premium will more than double (about 130 percent of the bill for someone buying at age 50), according to Genworth's long-term care cost calculator.

In this example, if a man alone got a policy at age 50, then the premium to receive $182,500 in covered benefits for a claim at 79 — the average age for filing a claim, according to the long-term care insurance group — would be $56,278, based on a monthly premium of $161.72. Waiting until 70 would mean a monthly premium of $370.88.

A woman pays more every step of the way when she's not part of a couple — as little as $43 more a month at age 50 and as much as $145 more at 70.

Rates for couples of the same age, no matter what gender, are less than double for the man alone.

And though a single New Jersey man's total premium outlay in the nine years from age 70 to 79 would be about $16,000 less, at $40,055, he risks being priced out of the market because of the higher premium. By waiting until 70, everyone is at greater risk of rejection for coverage because of poor health.

5-year window

The optimal age to shop for a long-term care policy, assuming you're still in good health and eligible for coverage, is between 60 and 65, financial advisers say. Couples might take a look five years earlier.

"If your health is OK and you don't have hereditary problems that insurance companies don't like, the ideal time to get long-term care insurance would be in your early 60s," says Diahann Lassus, cofounder of New Providence, New Jersey–based wealth management firm Lassus Wherley.

Why? You're not too young and you're not too old. A still-affordable monthly premium coupled with a total premium savings is a winning combination.

If the single man in New Jersey buys a long-term care policy at 60 rather than at 50, the monthly premium will increase by just $35 a month, but he'll save $11,540 in premiums through age 79, according to Genworth's cost calculator. If he waits until 65, the monthly premium will tick up to $239.20, but he'll save an additional $4,552 on total premiums.

But waiting those extra years also comes with a risk, Lassus and other financial planners caution. Anybody could be rejected for coverage because of failing health or medical-test results that point to a high probability of eventual health issues.

"By waiting, you are betting that you will stay healthy," says Michael Foguth, founder and president of Foguth Financial Group in Brighton, Michigan. "It's a calculated risk."

Be aware:Long-term care insurance premiums can increase over years. But an insurer must get approval from a state's regulators to raise the premium, something that doesn't happen with homeowner's insurance.

Long-term care insurers have been imposing significant rate hikes for nearly a decade, and the number of insurers offering this type of coverage has shrunk.

Should you self-insure?

What if you invest the money you would have put toward premiums to pay for long-term care? If you invested $161.72 a month from age 50 through age 79 and had a 7 percent return, your investment would grow to $174,880, according to an investment simulation run on Calculator.net.

Even though that would be nearly enough to afford the current cost of $182,500 for a two-year stay in a private room in a New Jersey nursing home and also serve as a savings account if you never need long-term care, self-financing your care that way is risky.

"That's no different than saying, 'I'm going to self-insure my house and will put money aside every month,'" Lassus says. "If you never have a problem, it's fine. But if your house burns down, your self-insurance fund might not be adequate."

One problem: You might not save the money every month. And even if you did, you might not get the 7 percent return you planned on, or the market might plunge just when you need the money, Foguth warns.

"The nursing home isn't going to wait for the market to rebound for you to pay your monthly bill," he says.

Decide by age 65

Generally speaking, most financial planners suggest that you purchase long-term care insurance by the time you're 65, which is also when most people are eligible for Medicare. That's not because Medicare covers long-term care, such as a stay at a nursing home — it doesn't.

The timing is more about the higher odds of your taking advantage of affordable Medicare coverage and having medical exams uncover issues that could make it more difficult to qualify for long-term care insurance.

When Ryan Graham, a financial adviser at Altfest Personal Wealth Management in New York City, evaluates a client's need for long-term care insurance, he considers a few things. First, he does an analysis to determine if a client has enough assets to pay for long-term care out of pocket.

Put another way, "Is insurance necessary?" he says.

He also asks his clients to analyze their family history with these questions:

- Health. Do family members have hereditary conditions?

- Long-term care. Have other family members needed assisted living or nursing care?

If the odds of needing future long-term care are high, the next step is to see if insurance "fits into their budget" and if it's "realistic to pay premiums," Graham says.

If clients — oftentimes spouses are buying insurance together — can afford to pay out of pocket or are willing to sell their house to pay for long-term care, buying insurance is not necessary, he says. But if they are risk averse and don't like the idea of unknown future costs, they should get the insurance.

"We have these conversations with clients every year starting at 45 and 50," Graham says. "Usually, the trigger is not pulled till later."

Freelance writer Adam Shell was a markets and Wall Street reporter for USA Today.

Can You Buy Long Term Care Insurance After 70

Source: https://www.aarp.org/caregiving/financial-legal/info-2019/when-to-buy-long-term-care-insurance.html#:~:text=The%20optimal%20age%20to%20shop,and%2065%2C%20financial%20advisers%20say.