How Long for Repo to Fall Off Credit

Many people find themselves in a situation where they are unable to make timely payments on their vehicle or car loan. In some cases, the lender will take possession of the vehicle and sell it at auction.

This is called repossession, which means that you have lost your car because you were late making payments. It can affect your credit score for years moving forward, even if you pay what's owed and remove the sale from public record, so it doesn't show up anymore. Here's how to keep this serious setback off of your credit report once and for all!

How long does a repossession stay on your credit report?

A car repossession stays on your credit report for up to 7 years. So while the impact lessens over time, it can negatively affect you the whole time it's on your credit report.

How does a repossession affect my credit score?

Having a repossession on your credit report can be very damaging to your credit score. A repossession may contribute to you not being able to get a loan for things like cars, credit cards, home loans, or anything else that requires a credit check. It hurts your credit score for as long as the repossession stays on your credit report.

Why do repos happen?

A car repossession typically occurs when you stop making payments on an auto loan.

When you get an auto loan, the bank you have the loan through technically owns the car until the loan is paid off in full. If you do not pay the loan in full and stop making payments, the bank can essentially take their car back from you.

Your lender can seize your vehicle at any time once your loan is in default. In most states, they don't even need to notify you that they will do this. Lenders will typically then sell the vehicle to try and recoup the money they loaned for its purchase.

What if it was a voluntary repossession?

Whether they have taken your car or you have voluntarily surrendered it, it makes no difference when it comes to your credit. The effects of the repo are just as damaging to your credit score.

Can I be sued for the remainder of the balance?

In addition to seizing your vehicle, the lender can sue you for the additional amount they lack to pay off their original investment.

For example, let's say you still owed $15,000 for a car, and that car got repossessed by the bank. The bank then sold that car for $10,000. The lender could still sue you for the remaining $5,000. The bank will almost certainly sue you for the remainder; then, you will also have a judgment on your credit report.

Can a repo be removed from your credit report?

Yes. It is possible to have a repo removed from your credit report before seven years. You can do one of two things:

- Sometimes a bank will allow you to renegotiate your payment terms so that you can afford to pay them more easily. If you can convince them to do this, they will sometimes remove the repossession for you. Make sure you get it in writing that they will delete the repo from your credit report once you have paid it in full.

- You can dispute the the repossession with the credit bureaus.

How to Dispute a Repossession

The Fair Credit Reporting Act (FCRA) requires that negative items on your credit report be accurate and true. So if you can find errors in the reporting of the repossession on your credit report, you can have it completely removed. And the burden of proof is on the credit bureaus.

To remove a repossession, you will need to file a dispute with the credit bureaus. If the lender can't verify that the repo is valid or fails to answer the dispute within 30 days, then they must remove the repossession from your credit report.

To file a dispute, you will first need to get your credit reports. You can get a free credit report from each of the 3 credit bureaus at AnnualCreditReport.com.

Once you have your credit reports, you will want to see if it's reporting on all 3 credit reports and then look for any errors or inaccuracies. You will then report the error to the credit bureaus reporting it by filing a dispute. You can do so by phone, mail, or online. Sending a letter to each credit bureau is the best way to do it.

Can I get a car loan after a repossession?

Yes, however, it's best to get the repossession on your credit report removed before applying for a loan. Unfortunately, very few lenders will give you a car loan with a repo on your credit history.

If they do, the amount of interest you'll be paying will be enormous. You may pay 3x to 4x what the car is worth.

Hiring a Credit Repair Company to Help Your Remove a Repossession from Your Credit Report

A good credit repair company like Lexington Law can also help you remove negative items like repossessions from your credit report. They have many years of experience helping people, and they make sure the job gets done correctly.

Lexington Law Client Testimonials:

I must commend your credit repair company and staff, on doing an exemplary job on my credit history. For the few months that I have been a client, their reputation represents that of professionalism, courteousness, and people oriented. I am extremely happy with the progress that has been made. Keep up the great work.

— R.S., Lexington client

— K.L. & B.L., Lexington clientsI am extremely satisfied with the service you offer your clients. I feel your firm is very committed and dedicated to obtaining results. Since I have been a client, I have been astonished by the amount of deletions you have been able to obtain for both my husband and myself.

I would never have been able to achieve the results you have on my own and hold down a full-time job at the same time. I look forward to getting your updated emails just to see how many more negative entries have disappeared.

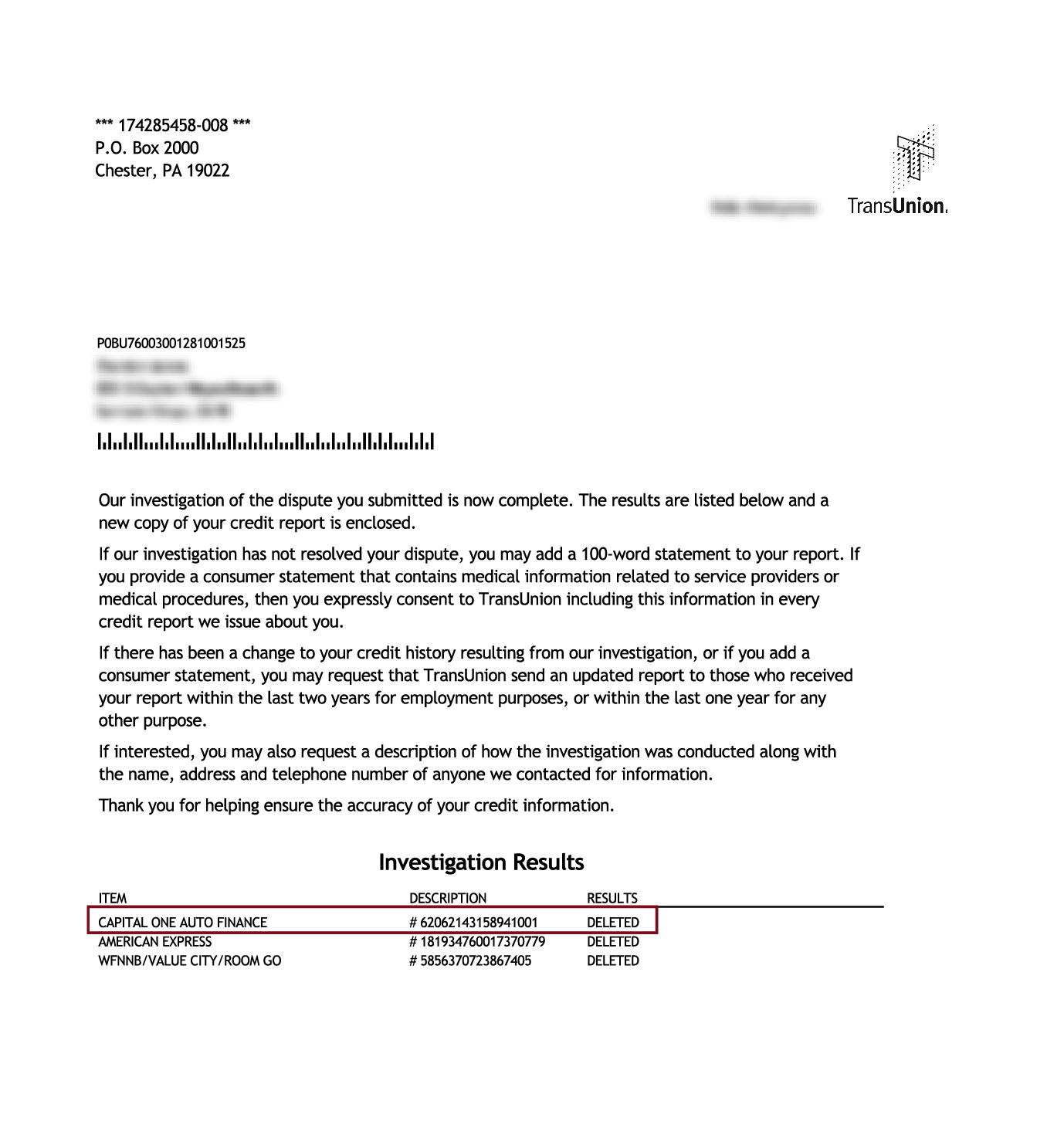

Letter from Transunion

Discount for Family Members, Couples, and Active Military!

Lexington Law is now offering $50 off the initial set-up fee when you and your spouse or family members sign up together. The one-time $50.00 discount will be automatically applied to both you and your spouse's first payment.

Active military members also qualify for a one-time $50 discount off the initial fee.

Meet the author

Lauren is a Crediful writer whose aim is to give readers the financial tools they need to reach their own goals in life. She has written on personal finance issues for over six years and holds a Bachelor's degree in Japanese from Georgetown University.

How Long for Repo to Fall Off Credit

Source: https://www.crediful.com/how-to-remove-repossession-from-credit-report/